Uneven cash flow stream calculator

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Using Excel 2007 how do I calculate a payment with uneven cash flows.

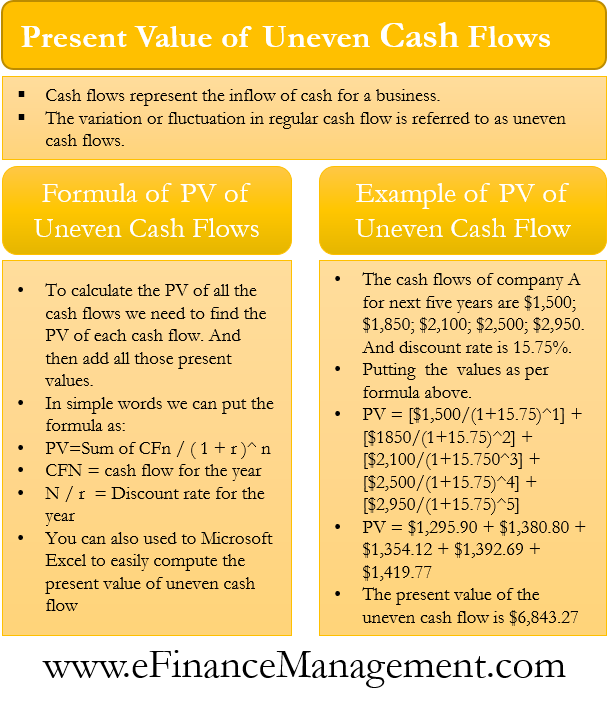

Present Value Of Uneven Cash Flows All You Need To Know

This function is defined as.

. The present value is equal to the cash flow in year zero plus the sum from year one to the terminal year of. Present value of an uneven stream of cash flows solved using the TI BA II Plus calculator. The appropriate interest rate is 11.

Uneven Cash Flow Stream. Rated the 1 Accounting Solution. In addition to the previously mentioned financial keys the 12C also has keys labeled CF 0 and CF j the cash flow keys to handle a.

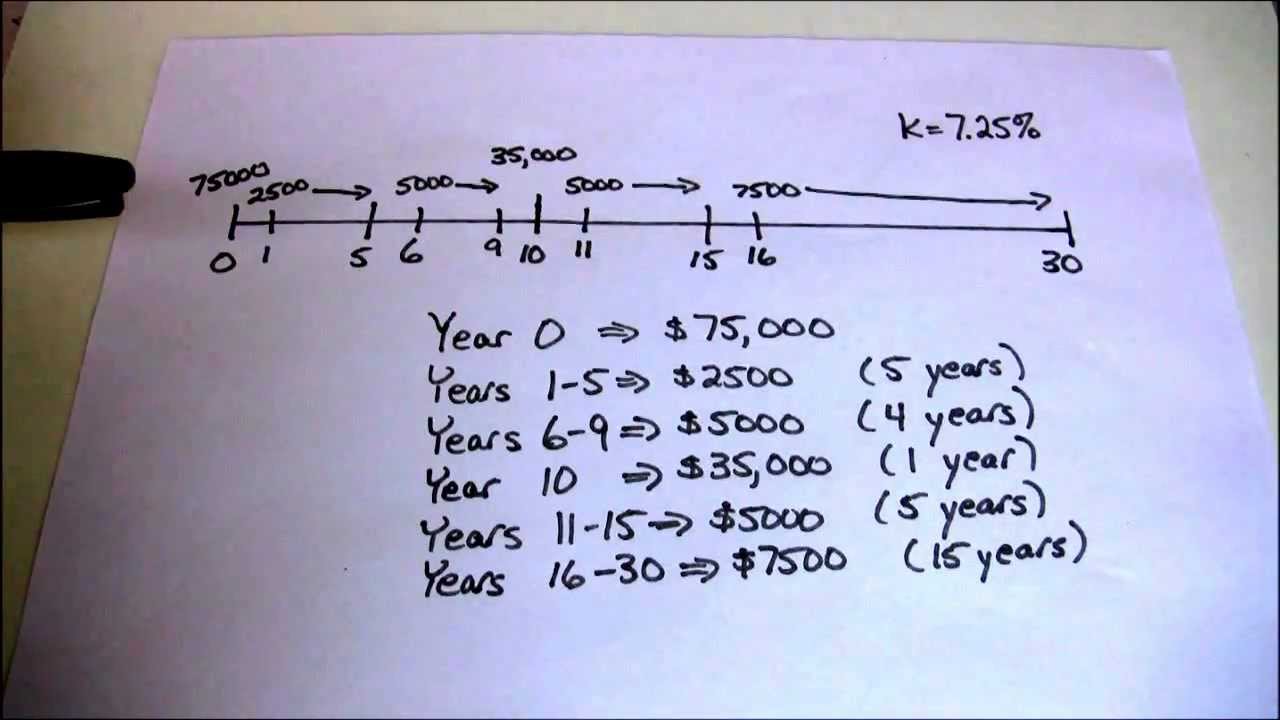

This video demonstrates how to calculate the Future Value of a series of uneven cash flows using a BAII Plus calculator. Or payments may be. Calculate the present value of an uneven cash flow stream.

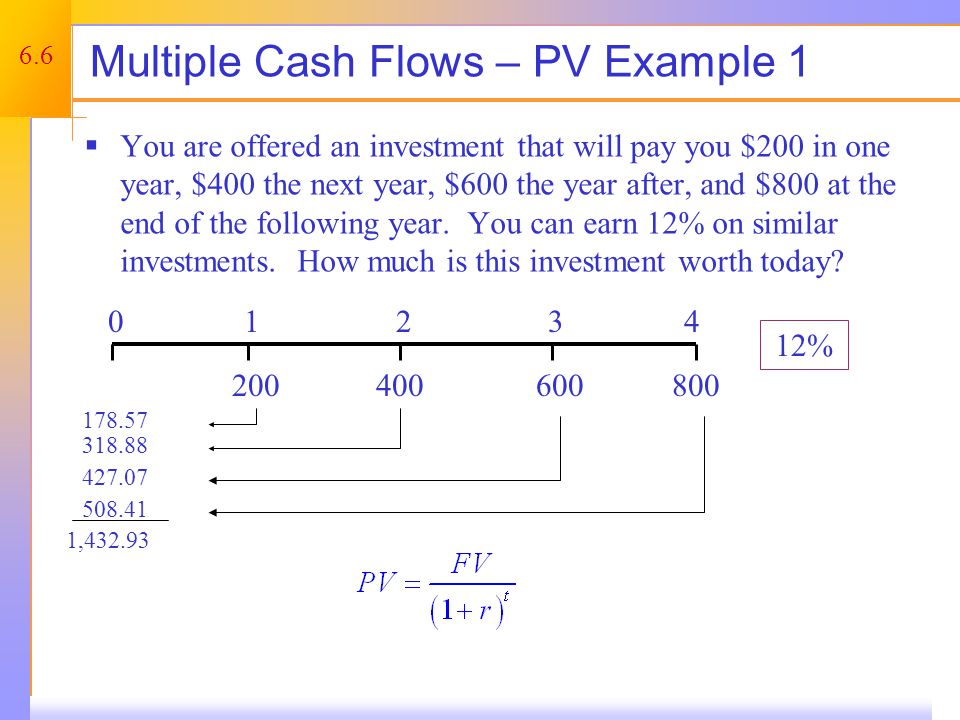

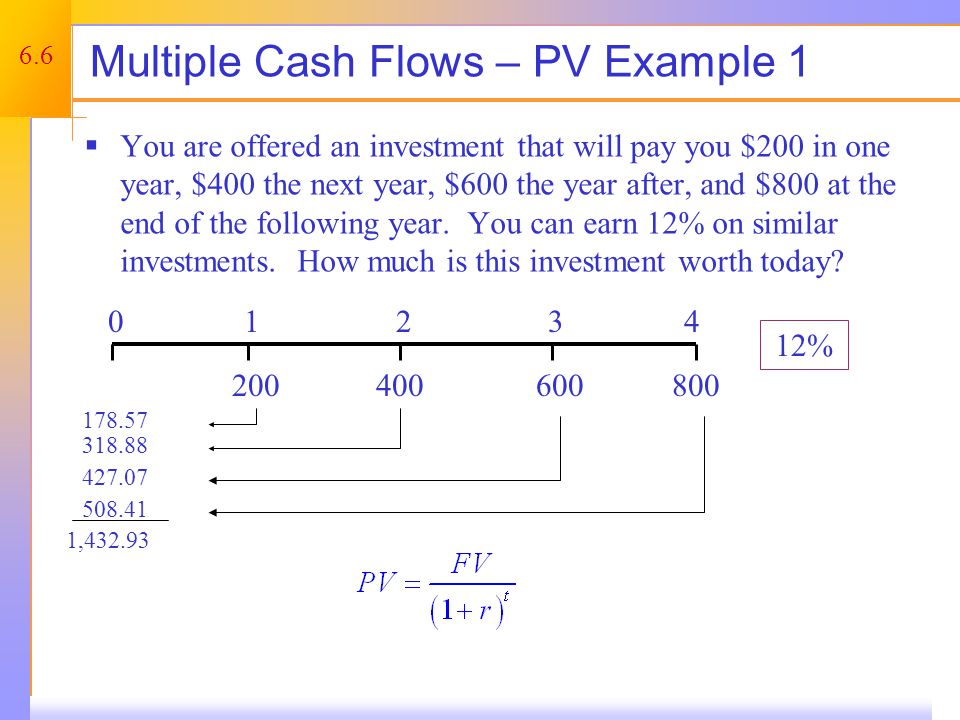

143-154The link to the calcula. This function is defined as. When a cash flow stream is uneven the present value PV andor future value FV of the stream are calculated by finding the PV or FV of each individual cash flow and adding.

Annuity also referred to as constant or even cash flows and. NPVRateCash Flow 1Cash Flow 2Cash Flow 3. Ad QuickBooks Financial Software.

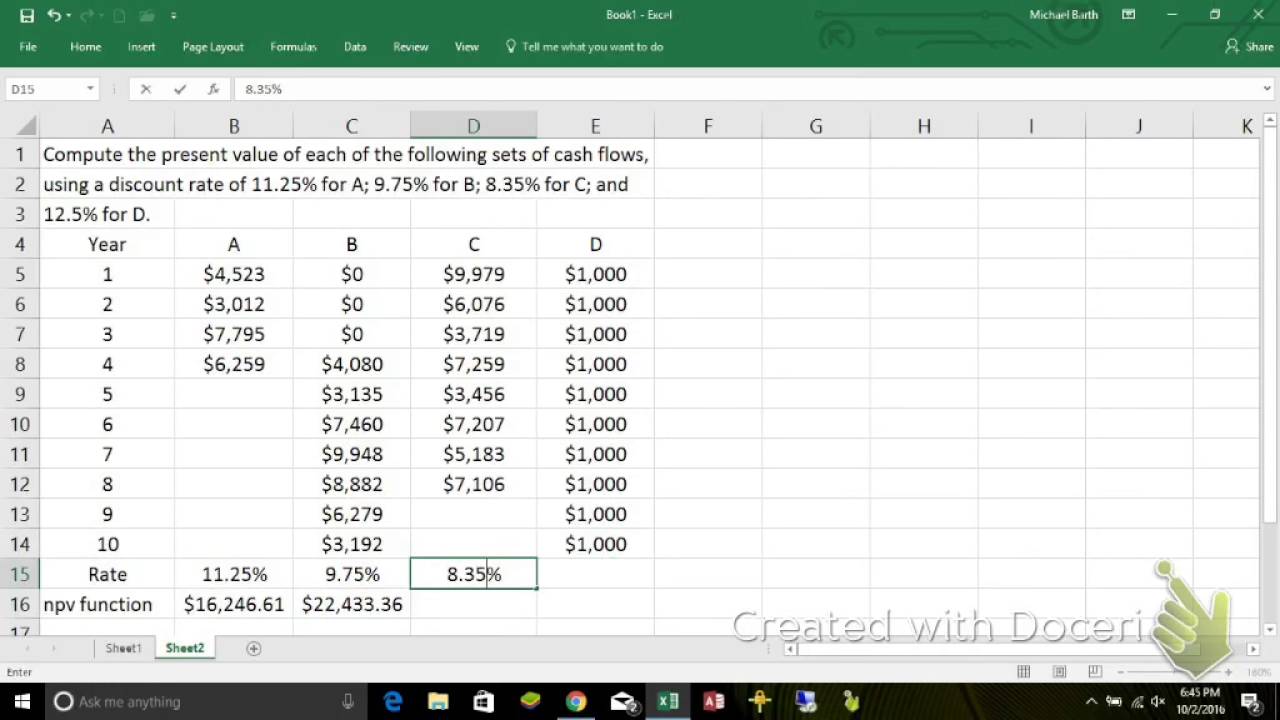

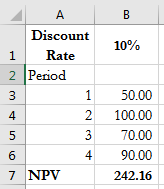

Using the Online Calculator to Calculate Present Value of Cash Flows Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise. NPV Rate Initial Outlay Cash Flows Cash Flow Counts Note. To find the present value of an uneven stream of cash flows we need to use the NPV function.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. To find the present value of an uneven stream of cash flows we need to use the NPV net present value function. Build Your Future With a Firm that has 85 Years of Investment Experience.

It is fairly easy to work this problem dealing with the. Find the present values of the following cash flow streams. C11 is the discount rate.

For example amount funded is on 131 first payment due is on 31. Using the key One can also find the interest rate of the uneven cash flow stream with a financial calculator and solving for the Quantitative Problem you own a security with the cash flows. Rated the 1 Accounting Solution.

Build Your Future With a Firm that has 85 Years of Investment Experience. Example 3 Present Value of Uneven Cash Flows. NPV C11C5C9 the NPV function uses a discount rate and series of cash flows to find out the net present value of a financing system.

Irregular varying or uneven cash flows. Ad QuickBooks Financial Software. Here we see how to calculate the Net Present Value and Internal Rate of Return for an uneven stream of future cash flows.

A valid cash-flow series for an IRRYR calculation must have at least.

Excel S Npv Function For Pv Of Uneven Cash Flows Youtube

Uneven Cash Flow Streams On The Ti 83 Or Ti 84 Youtube

2022 Cfa Level I Exam Cfa Study Preparation

Present Value Of Uneven Cash Flows Ba Ii Plus Fin Ed Youtube

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Uneven Cash Flow Streams On The Hp10bii Youtube

Calculate The Future Value Fv Of Uneven Cash Flows On Excel Two Methods Youtube

Present Value Of Cash Flows Calculator

Present Value Of Uneven Cash Flows All You Need To Know

The Time Value Of Money Introduction To Time

Uneven Cash Flow Streams On The Ti Baii Youtube

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Chapter Outline Future And Present Values Of Multiple Cash Flows Ppt Video Online Download

Financial Management I Review Ppt Download